Step 1: Let us know the basics

Answer some easy questions about finances and card your looking for.

Step 2: See Your Matches

We will show your best card matches and what your approval odds are for them.

Step 3: Time to decide

Compare all your personalized options and select the card you like best.

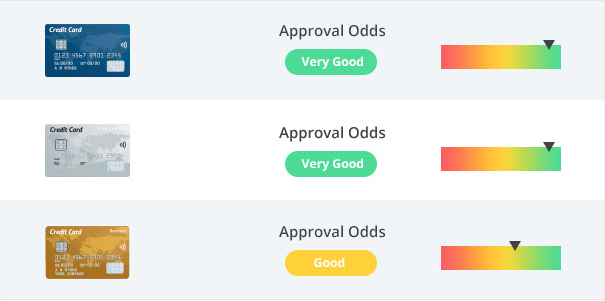

Built with approval odds to help you decide

When you get your results, our approval odds tool calculates which cards you’re most likely to be approved for based on your credit profile and other factors. This can help you prioritize your picks, but final approval is up to the card issuer.

50

People Matched to a card they are interested in that fits their credit profile

10

Cards matched per person on average

25

Trusted banks available through CardMatch

Frequently asked questions

How does CardMatch work?

First, you’ll answer some questions about your card preferences and credit profile. Based on your responses, we’ll recommend your top card matches.

How will you determine my matches?

Your matches will be determined by an algorithm that takes into account a number of different factors, including your credit profile, lifestyle and overall preferences.

What card issuers do you work with?

We bring you card offers from some of the industry’s most trusted issuers, including American Express, Discover, Bank of America, Wells Fargo, U.S. Bank, Citi and Chase.

Will CardMatch impact my credit?

Nope! While we’ll run a soft credit pull to determine which cards you’re likely to qualify for, this is a standard process that will not impact your credit score.